A labor pathway hypothesis related to correlation. This is not a formal conjecture and has not been researched thoroughly.

Correlation of Labor to inflation (nominal) can be nearly assumed to the Taylor rule (http://en.wikipedia.org/wiki/Taylor_rule) in economics as gross domestic product can be related to labor's productivity of current resources and technology.

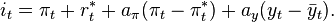

Taylor Rule (from Wikipedia):

as i = nominal interest rate

pi = current inflation

pi* = inflation desire

alpha pi= a_pi = adjustment weight for inflation

r* = real interest rate at market

y= GDP

y_bar = potential GDP output

alpha y = y_pi = adjustment weight for GDP

if modified the Taylor rule can be adjusted for increasing inflation based on overall spread and depth of the debt load in an economy by forgiving debt (equally and spread throughout the economy) or by having direct from treasury payments to households during downward GDP cycles. Then...

add these possible terms to the Taylor Rule:

b(L*a_pi*z_pi) or

b(L*a_pi*(1-z_pi)) and if and only if

pi < zero

or if pi <pi* and in correlation to pi, y

as

b =beta = fraction of liabilities to be waived or forgiven; 0 <= b <=1

L = liabilities in the economy

z_pi = a correlation of liability forgiveness to inflation that could be affected by forgiving that portion of liabilities at beta

i = pi + r* + a_pi (pi-pi*) + a_y(y-y_bar) + b(L*a_pi*z_pi)

***I am attributing z_pi instead of (1-z_pi) for the sake of argument, if liabilities forgiven causes reduced inflation and higher GDP then it is attributable to use (1-z_pi) but this requires extensive research.

If L is solved in the equation then we come across the liabilities forgiveness based on this equation:

L = [i - pi - r*- a_pi (pi-pi*) - a_y(y-y_bar)]/(b(a_pi*z_pi))

note that b(a_pi*z_pi) is acting like a multiplier to liabilities forgiveness relative to the interest rate at hand. L in this case might be a percentage basis but if in discrete currency unit amount then that would be followed as well.

Likewise, how much in liabilities to forgive is left up to policy makers, and other critical factors. (Think about if there was a partial global jubilee, then what debt should be forgiven?)

Several critical factors can be summed up to a proxy of indicators of how currency works.

From the start, currency starts from the earth and is traded on trust of product surplus.

As trust is a factor, banks are administrators of that trust and thus we must start there for any factors.

Correlation between Bank solvency and labor in relation to inflation and bank solvency? (corr(bs,l)::corr(inf,bs))

If zero then what is the correlation between labor and inflation. Note that these are correlations and are predicated on the means and statistics of all industries and how they interlock in trade. This schedule of industries can be related to a variance in relation to a nation as a war machine against (nature, values, nationhood, feelings, etc...)

Clearly, bank solvency is the correlation question among many economic scholars. Let alone the question of liabilities per account and net income per income potential. This is the banker's quandary (along with the correlations in the paragraph above.)

Also note that Okun's law can be related to the Taylor Rule (the law is only a rule of thumb on previous observations: http://en.wikipedia.org/wiki/Okun's_law)

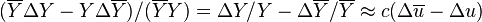

as Okun's Law is written as

where:

where:y= GDP

y_bar = potential GDP output

u = unemployment

u_bar = potential unemployment

c = factor relating changes in unemployment to changes in output

so

c = ((y_bar - y)/y_bar)/(u-u_bar)

and as estimating where the future should be is hard to predict, measuring changes can be done with:

where:

where:k = the average annual growth rate of full-employment output

delta y = one period change of GDP to the next

delta u = one period change of unemployment to the next

and k can be solved: delta y / y + c* delta u = k

(Original equation courtesy from wikipedia and the scholars before me):

, the change in the natural rate of unemployment, is approximately equal to 0. We also assume that

, the change in the natural rate of unemployment, is approximately equal to 0. We also assume that  , the growth rate of full-employment output, is approximately equal to its average value,

, the growth rate of full-employment output, is approximately equal to its average value,  . So we finally obtain

. So we finally obtain

Thus:

We can relate Okun's into Taylor's by:

(y_bar - y)/y_bar = c * (u - u_bar)

(y_bar - y) =y_bar* c * (u - u_bar)

(y - y_bar) = -(y_bar*c*(u - u_bar)) ::: note that the negative sign is negative one multiplied throughout every part so it really read: -(y_bar*c*(u - u_bar)) --> -y_bar*-c*(u_bar - u)

then,

i = pi + r* + a_pi (pi-pi*) + a_y(y-y_bar) --> i = pi + r* + a_pi (pi-pi*) + a_y(-(y_bar*c*(u - u_bar)))

therefore anyone can manipulate the unemployment rate via GDP as coupled via Okun's law. However, unemployment and GDP is separated from many different utility factors from supply and demand of individual markets and the willingness to participate in the market itself.

when coupled with debt forgiveness we can see the effect unemployment and GDP growth can have on how much debt needs to be forgiven at any one time (a partial or conditional jubilee.)

or Liabilities is written as:

{{ from above: L = [i - pi - r*- a_pi (pi-pi*) - a_y(y-y_bar)]/(b(a_pi*z_pi)) }}

L = [ i - pi - r*- a_pi (pi-pi*) - a_y(-(y_bar*c*(u - u_bar))) ]/(b(a_pi*z_pi))

This would mean that when liabilities are forgiven at a rate (from zero to 100% (or more if there is excess wealth)) then GDP and employment should gain and more tax revenue can be collected anyway. note that a_y is negative and can become positive if the negative of -(y_bar*c*(u - u_bar)) term or - a_y(y-y_bar term is used to cancel it out. Therefore, it is wise to forgive debt on a national and personal scale as it provides increased utility throughout the economic growth process.

If interest rates become negative, then it is possible that getting interest rates to become more positive with more buying power into consumers and investors/businesses to cause conditional or whole (b and z_pi = 1) jubilee. Again the conditional jubilee standard is only possible if and only if there is a social trust in that type of institutional standard to happen.

Again, this is a macro based equation and L is probably written as a percentage of total debt that a society (public and/or private) contains.

In essence, trust must be established in order for this to work. As far as I can tell, that trust is mostly true across the world and a jubilee is probably a better thing than all out debt slavery or other weird debt instrument can inspire. One thing remains in all of this, as Real Estate is a wealth transfer mechanism of the productivity of the land (and the people who dwell on that land.) Real Estate should be respected as what it is, earth and only earth. Earth only because that is the tangibility of the property that exists there. Overall, a jubilee should account for how mismanaged the earth really is and how much real estate redevelopment can be done to:

1. Minimize traffic and fuel usage:

Our fossil fuel world requires those who mine for energy minerals to place suburbs as far away as possible without discriminating demand to their working jobs. This maximizes their incentives of profits.

2. Reestablish energy distribution as before giant banking cartels:

Energy is in the form of food and other stuff, as our farmlands and psychopathic neighbors in the sky spraying chemtrails, it is sad to see that people eat what they think is safe rather than being able to grow food themselves (why cannot this be part of a regular middle school/high school curriculum (vegetable and fruit horticulture). Granted it is still eating from the wild chemtrail wonder, but at least there can be food and energy independence.

3. Minimize employment hours and maximize personnel distribution in the firm (but minimize the real estate distances needed to achieve it.

Overall, we need to build a better world. But how can visionaries achieve it when saddled with too much debt? They cannot. The Artist of the world was starving because he invested into the art he made...his own body. The economy is the same. Economic cultivation is required (micro and macro) in order to get that reality to become true.

He who has the ability, can create more to help fellow man, than one who has to hide and work for the mistakes of novel past.

Again: more research is required to gain the underhand in all of this data.

and k can be solved: delta y / y + c* delta u = k

(Original equation courtesy from wikipedia and the scholars before me):

, the change in the natural rate of unemployment, is approximately equal to 0. We also assume that

, the change in the natural rate of unemployment, is approximately equal to 0. We also assume that  , the growth rate of full-employment output, is approximately equal to its average value,

, the growth rate of full-employment output, is approximately equal to its average value,  . So we finally obtain

. So we finally obtain

Thus:

We can relate Okun's into Taylor's by:

(y_bar - y)/y_bar = c * (u - u_bar)

(y_bar - y) =y_bar* c * (u - u_bar)

(y - y_bar) = -(y_bar*c*(u - u_bar)) ::: note that the negative sign is negative one multiplied throughout every part so it really read: -(y_bar*c*(u - u_bar)) --> -y_bar*-c*(u_bar - u)

then,

i = pi + r* + a_pi (pi-pi*) + a_y(y-y_bar) --> i = pi + r* + a_pi (pi-pi*) + a_y(-(y_bar*c*(u - u_bar)))

therefore anyone can manipulate the unemployment rate via GDP as coupled via Okun's law. However, unemployment and GDP is separated from many different utility factors from supply and demand of individual markets and the willingness to participate in the market itself.

when coupled with debt forgiveness we can see the effect unemployment and GDP growth can have on how much debt needs to be forgiven at any one time (a partial or conditional jubilee.)

or Liabilities is written as:

{{ from above: L = [i - pi - r*- a_pi (pi-pi*) - a_y(y-y_bar)]/(b(a_pi*z_pi)) }}

L = [ i - pi - r*- a_pi (pi-pi*) - a_y(-(y_bar*c*(u - u_bar))) ]/(b(a_pi*z_pi))

This would mean that when liabilities are forgiven at a rate (from zero to 100% (or more if there is excess wealth)) then GDP and employment should gain and more tax revenue can be collected anyway. note that a_y is negative and can become positive if the negative of -(y_bar*c*(u - u_bar)) term or - a_y(y-y_bar term is used to cancel it out. Therefore, it is wise to forgive debt on a national and personal scale as it provides increased utility throughout the economic growth process.

If interest rates become negative, then it is possible that getting interest rates to become more positive with more buying power into consumers and investors/businesses to cause conditional or whole (b and z_pi = 1) jubilee. Again the conditional jubilee standard is only possible if and only if there is a social trust in that type of institutional standard to happen.

Again, this is a macro based equation and L is probably written as a percentage of total debt that a society (public and/or private) contains.

In essence, trust must be established in order for this to work. As far as I can tell, that trust is mostly true across the world and a jubilee is probably a better thing than all out debt slavery or other weird debt instrument can inspire. One thing remains in all of this, as Real Estate is a wealth transfer mechanism of the productivity of the land (and the people who dwell on that land.) Real Estate should be respected as what it is, earth and only earth. Earth only because that is the tangibility of the property that exists there. Overall, a jubilee should account for how mismanaged the earth really is and how much real estate redevelopment can be done to:

1. Minimize traffic and fuel usage:

Our fossil fuel world requires those who mine for energy minerals to place suburbs as far away as possible without discriminating demand to their working jobs. This maximizes their incentives of profits.

2. Reestablish energy distribution as before giant banking cartels:

Energy is in the form of food and other stuff, as our farmlands and psychopathic neighbors in the sky spraying chemtrails, it is sad to see that people eat what they think is safe rather than being able to grow food themselves (why cannot this be part of a regular middle school/high school curriculum (vegetable and fruit horticulture). Granted it is still eating from the wild chemtrail wonder, but at least there can be food and energy independence.

3. Minimize employment hours and maximize personnel distribution in the firm (but minimize the real estate distances needed to achieve it.

Overall, we need to build a better world. But how can visionaries achieve it when saddled with too much debt? They cannot. The Artist of the world was starving because he invested into the art he made...his own body. The economy is the same. Economic cultivation is required (micro and macro) in order to get that reality to become true.

He who has the ability, can create more to help fellow man, than one who has to hide and work for the mistakes of novel past.

Again: more research is required to gain the underhand in all of this data.

No comments:

Post a Comment